Navigating the Home Insurance Process

Let’s talk about something that can feel overwhelming: a storm-damaged roof. You’ve just survived a big storm, maybe a hailstorm or a nasty wind event, and now you’re looking up at your roof with a knot in your stomach. What do you do? Who do you call? And how in the world does a homeowner’s insurance claim even work?

Take a deep breath. We’ve been through this countless times with homeowners just like you, and we’re here to walk you through it. This isn’t just a business for us; it’s about helping our community get back on its feet. We want to demystify the process and give you the confidence to handle this situation with a clear head.

First things first: The Initial Inspection

Before you call your insurance company, it’s a great idea to have a professional roofer take a look. Why? Because a professional can give you an accurate assessment of the damage, which helps you when you talk to your insurance adjuster. Many homeowners don’t realize they have storm damage until they see a leak. By then, the damage has often had time to spread, potentially causing issues to your interior.

When we at Eagle Eye Roofing come out for an initial inspection, we’re looking for a few things:

Hail Damage

This can look like small, round divots or dents on shingles. On a Metal Roof, this damage can be more subtle, appearing as dents or scrapes in the protective coating.

Wind Damage

Look for missing shingles, creased or “lifted” shingles, or damage to the flashing around chimneys and vents.

Other Damage

We’ll also check for punctures from falling branches and signs of wear and tear that might be exacerbated by the storm.

An honest contractor will tell you if the damage is significant enough to warrant an insurance claim. A common misconception is that a few missing shingles automatically means a total roof replacement. That’s not always the case. We’ll give you a straightforward, honest assessment, complete with photos, so you know exactly what you’re dealing with.

Making the Call: A Step-by-Step Guide to Your Insurance Claim

Once you have a professional assessment in hand, it’s time to contact your insurance company. This is a crucial step, and knowing what to say can make a world of difference.

File the Claim: Call your insurance company’s claims department. Be prepared to provide your policy number, the date of the storm, and a brief description of the damage. Don’t worry if you don’t know all the details—that’s what the adjuster is for. Just be honest and straightforward.

Request an Adjuster: The insurance company will schedule a time for an adjuster to come out and inspect the damage. This is where having a professional roofer on your side can really pay off.

The Adjuster’s Visit: We highly recommend having your chosen roofer present during the adjuster’s visit. A knowledgeable roofer can point out damage that might be missed by an adjuster, especially if the damage is subtle, like on a Metal Roof or on certain types of composite shingles. Our team has a great relationship with many insurance adjusters because we speak their language. We can discuss the scope of the damage, the required repairs, and the materials needed, ensuring everyone is on the same page. This collaboration often leads to a smoother, faster claim approval process.

Understanding the Paperwork: The Claim Summary

After the adjuster’s visit, you’ll receive a claim summary. This is an important document that outlines the scope of work the insurance company has approved, the cost they’ve estimated, and the amount they will pay out. Take your time to review this document.

The claim summary will typically have a few key sections:

![]() ACV (Actual Cash Value) Payment: This is the initial check you’ll receive. It’s the depreciated value of your roof, meaning it accounts for the roof’s age and wear.

ACV (Actual Cash Value) Payment: This is the initial check you’ll receive. It’s the depreciated value of your roof, meaning it accounts for the roof’s age and wear.

Deductible: This is the amount you are responsible for paying out-of-pocket before your insurance coverage kicks in.

Deductible: This is the amount you are responsible for paying out-of-pocket before your insurance coverage kicks in.

![]() RCV (Replacement Cost Value): This is the total cost of the roof replacement, including all approved line items. You’ll receive the remaining balance of this amount, minus the ACV already paid, once the work is completed.

RCV (Replacement Cost Value): This is the total cost of the roof replacement, including all approved line items. You’ll receive the remaining balance of this amount, minus the ACV already paid, once the work is completed.

This process can feel a little complicated, but don’t worry. A reputable Top reviewed roofing company will help you understand every line item on that claim summary and ensure that all necessary repairs are included.

Choosing the Right Team: How to Find a Trustworthy Roofing Contractor

This is perhaps the most critical step of all. Not all Roof contractors are created equal. In the wake of a big storm, you’ll see “storm chasers” descend on your neighborhood. These are often out-of-town companies that promise quick fixes but may not be around if you have a problem down the line. They might pressure you into signing a contract immediately and make promises that sound too good to be true.

So, how do you find a contractor you can trust? Here’s our checklist:

Local Presence: Choose a contractor with a strong local presence. Do they have a physical office in your area? Do they have a good reputation in the community? A local company like Eagle Eye Roofing is invested in the community and will be here for the long haul.

Proof of Insurance and Licensing: Always, always, always ask for proof of general liability insurance and workers’ compensation. This protects you in case of an accident on your property. Also, ensure they are properly licensed.

Customer Reviews and References: The best way to vet a company is to see what their past clients say. Look for a Top reviewed roofing company on platforms like Google, the Better Business Bureau, and Angie’s List. Read the good and the bad reviews. We’re proud of our five-star rating and the positive feedback from our neighbors. We believe it speaks to our commitment to quality and service.

Written Contract: A professional contractor will provide a detailed, written contract that outlines the scope of work, the materials to be used, the project timeline, and the total cost. Never sign a blank contract or one with vague promises.

Transparent Communication: A good contractor will communicate with you every step of the way, from the initial inspection to the final walkthrough. You should feel comfortable asking questions and getting clear, concise answers.

The Incredible Journey of Home Insurance

We know that the whole process—especially the insurance part—can feel a little bit like a mystery. So, let’s peel back the curtain and take a look at the fascinating history of how we got to where we are today.

Understanding where home insurance came from isn’t just a fun history lesson; it gives you a deeper appreciation for the protection it provides and why certain aspects of your policy exist. It’s a story of communities coming together, of learning from devastating events, and of a whole industry evolving to meet our needs.

From Volunteer Brigades to Benjamin Franklin

The earliest ideas of insurance in America were born out of necessity, long before we had formalized companies and policies. Think about our colonial towns: most buildings were made of wood, packed closely together, and lit by candles. Fire was a constant, terrifying threat. When a fire broke out, the entire community would rush to help, passing buckets of water and tearing down neighboring buildings to create a fire break. This was the original “mutual aid” system—an unwritten understanding that your neighbors would help you, and you would help them.

The earliest ideas of insurance in America were born out of necessity, long before we had formalized companies and policies. Think about our colonial towns: most buildings were made of wood, packed closely together, and lit by candles. Fire was a constant, terrifying threat. When a fire broke out, the entire community would rush to help, passing buckets of water and tearing down neighboring buildings to create a fire break. This was the original “mutual aid” system—an unwritten understanding that your neighbors would help you, and you would help them.

This informal system started to get more organized. In 1736, Benjamin Franklin, ever the innovator, founded the Union Fire Company in Philadelphia, one of the first volunteer fire departments in America. These companies were a huge step forward, but they didn’t offer financial protection. The threat of a fire still meant total financial ruin.

This informal system started to get more organized. In 1736, Benjamin Franklin, ever the innovator, founded the Union Fire Company in Philadelphia, one of the first volunteer fire departments in America. These companies were a huge step forward, but they didn’t offer financial protection. The threat of a fire still meant total financial ruin.

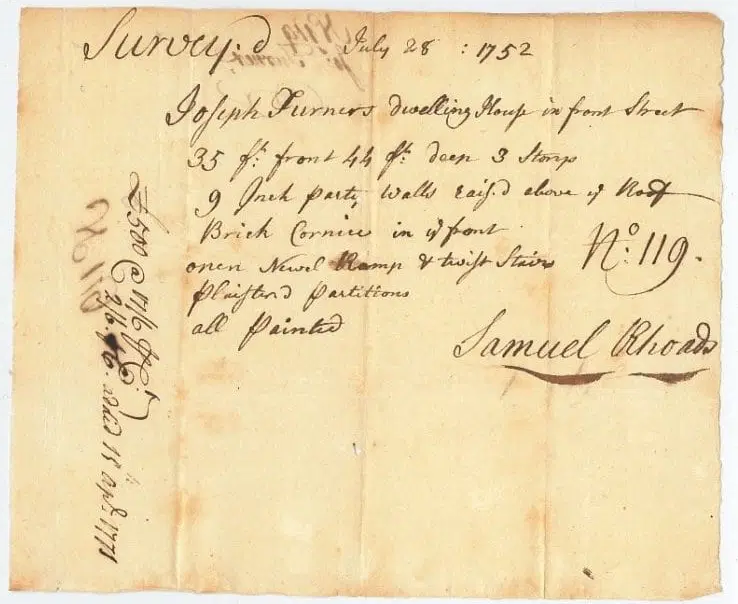

Recognizing this gap, Franklin went on to help found the Philadelphia Contributionship in 1752. This was a truly groundbreaking moment. It was the first mutual fire insurance company in the colonies. The idea was simple but powerful: members paid into a common fund, and if any member’s house burned down, the fund would be used to help them rebuild. They even refused to insure buildings deemed too risky, like those with certain types of wooden chimneys, setting the stage for modern risk assessment and underwriting.

The “Fire Marks”

These early companies didn’t just offer protection; they also gave their policyholders a physical sign of coverage. If you had a policy with the Philadelphia Contributionship, you would have a special plaque called a “fire mark” mounted on the front of your home. The Contributionship’s mark was a symbol of four hands clasped together.

These marks were a big deal! They let the volunteer fire brigades know that your house was insured, and since they were often funded by the insurance companies themselves, they would prioritize fighting fires at marked properties. This system of identifying insured homes and businesses became a cornerstone of early property protection and shows just how interconnected insurance and community safety have always been.

Fires, Earthquakes, and the Push for Regulation

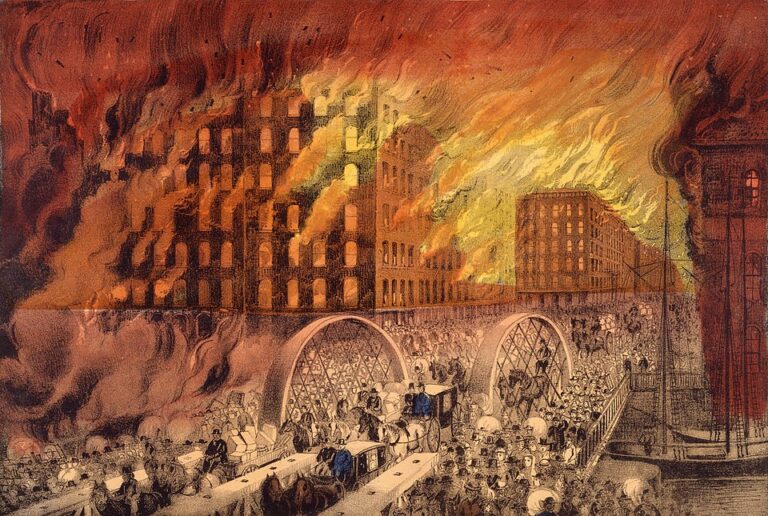

As America grew, so did the risks. The 19th century was a time of rapid urbanization, and with more people living in bigger cities, the potential for catastrophe grew exponentially. The Great Chicago Fire of 1871 was a massive wake-up call for the insurance industry. The fire destroyed over 17,000 buildings, and the financial losses were staggering—over $200 million in damages.

The fire revealed a lot of weaknesses. Many insurance companies, especially the smaller, less-prepared ones, went bankrupt overnight, leaving thousands of policyholders without a dime. This devastating event made it clear that the industry needed better regulation and stronger financial reserves. It prompted states to create insurance departments and enact new laws to ensure that companies were stable enough to pay out claims, even after a massive disaster.

Major events like this, from the San Francisco earthquake of 1906 to the devastating hurricanes of the 20th century, continually forced the insurance industry to adapt. Each disaster exposed new vulnerabilities and led to the development of more comprehensive policies and better risk management.

The Birth of the Modern Homeowners Policy

For most of the 19th and early 20th centuries, homeowners had to buy separate policies to cover different risks. You would have one policy for fire, another for wind or hail, and maybe another one for theft. Imagine having to manage three or four different policies for one house! It was complicated, expensive, and a real hassle.

Everything changed in the 1950s. After World War II, America experienced a massive housing boom. The “American Dream” of homeownership became a reality for millions, and the insurance industry needed a product that was easier to understand and more comprehensive. In 1950, a company called the Insurance Company of North America (INA) introduced the very first homeowners policy.

This was a revolutionary moment. For the first time, a single policy covered the structure of the house, personal belongings inside, and even liability if someone was injured on the property. It was a bundled solution that simplified everything and made insurance more accessible to the average person. This new, standardized policy was the blueprint for what we all have today, with different versions (like HO-1, HO-2, and HO-3) offering varying levels of coverage.

The Future of Insurance and Your Roof

So, what does this history lesson mean for you today? It means that the policy you have isn’t just a product; it’s the result of centuries of learning from both big and small disasters. It’s a testament to the idea that by coming together, we can protect each other from the unexpected.

Today, the challenges are different. We face increasingly severe weather, and the cost of building materials and labor has gone up. That’s why it’s so important to have a company like Eagle Eye Roofing on your side—a company that understands not just how to fix a roof, but also how to work within the modern insurance framework. We’re here to help you navigate the system that took so long to build, ensuring you get the full value of the protection you’ve paid for.

Knowing this history, we hope you feel more empowered and confident about your homeowner’s policy. It’s more than just a piece of paper; it’s your key to financial recovery and peace of mind when a storm rolls in. If you have any questions about your policy or need an inspection, give us a call! We’re always here to help.

The Eagle Eye Roofing Difference

At Eagle Eye Roofing, we’ve built our reputation on trust, quality, and a commitment to our community. We handle the entire process for you, from the initial inspection to the final cleanup. We’ll meet with your insurance adjuster, help you understand the claim summary, and ensure the work is done to the highest standards.

Whether you have a traditional asphalt shingle roof or are considering a durable Metal Roof, our team has the expertise to get the job done right. We only use high-quality materials and employ skilled, experienced craftsmen. Our goal isn’t just to fix your roof; it’s to give you peace of mind knowing your home is safe and protected.

Storm damage can be a stressful event, but with a little knowledge and the right team on your side, it doesn’t have to be. We’re here to help you navigate this process smoothly and get your home back to normal. If you think your home has suffered storm damage, don’t hesitate to give us a call for a free, no-obligation inspection. We’re here for you.